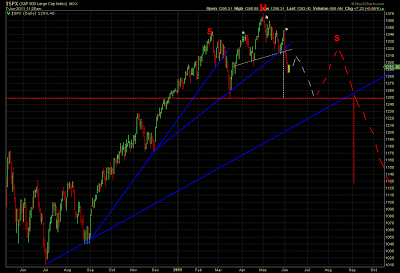

In my original 2011 stock market forecast

I was uncertain about two possible scenarios and I decided to wait the

first week of January to make a better assessment of the odds.

What I have seen is enough to me for choosing the bearish

option but with some changes: I think this market will remain bullish

till March with only small 10/15 points corrections along its way to a

1296-1316 in a low volatility environment similar to what we experienced

over the last couple of months. We will likely see a final spike and a

distribution process during April and May with more volatility and wider

swings, during the summer a slow declining market and in September a

quite bearish month that could drag the market up to 10% lower relative

to where it started 2011 some recovery during the last part of the year

should not prevent the market to

close slightly negative for the year.

This

is my final forecast for 2011: it is based on a very specific time

cycle that I expect to be repeated, if I choose the wrong cycle it may

be totally wrong. Anyway since we do not trade on forecasts but on what

we see on the screen this will not affect our trading! Please do not

rely on it, I post it just because I promised and because someone asked

me to, it is intended to be an entertaining only exercise not an

investment or trading advice!!!! Most likely we will look at

it at the end of 2011 just to say: "OK he got it right" or to laugh

about it in case it proves to be totally wrong as

most of the long term forecasts are in the end. Short term trading is

another story, to deal with it we have other instruments. Besides

if I look back to 2010 the only two bad months were September and

December just when I had a strong negative bias that prevented me to see

that the market was simply going the other way around, if anything this

year I want to avoid such silly mistakes that are supposed to be made

only by first timers but sometimes unfortunately cannot be avoided

by the more experienced ones too....and this is the only real

advice I make here for my readers: you too should keep an open mind this

year, do not marry a forecast, a side of the market or an idea, trade

what you see .

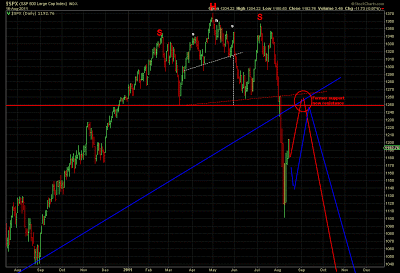

June Update to our 2011 Stock Market Forecast

August 16, 2011 Bearish H&S pattern completed as expected now waiting for a consolidation phase

SEPTEMBER UPDATE:

Sep. 14, 2011 Waiting for the next leg down to 1040-1000 to start as soon as the back-test is completed

Sep 14, 2011: I have revised down the target for the next leg down to 1040-1000 to be reached as soon as the back-test of the broken support is completed (it will fail short of it). Once the revised target is reached the market will start a recovery into year end to close the around 1150 if history continue to repeats itself and the cycle I am tracking keep working as it has been working so far up to this point.

Forecast(above) Actual (below)

Early June 2011

This is (as of early June 2011) how the original 2011 forecast could be tentatively fulfilled (if it right in the end...)August 16, 2011 Bearish H&S pattern completed as expected now waiting for a consolidation phase

SEPTEMBER UPDATE:

Sep. 14, 2011 Waiting for the next leg down to 1040-1000 to start as soon as the back-test is completed

Sep 14, 2011: I have revised down the target for the next leg down to 1040-1000 to be reached as soon as the back-test of the broken support is completed (it will fail short of it). Once the revised target is reached the market will start a recovery into year end to close the around 1150 if history continue to repeats itself and the cycle I am tracking keep working as it has been working so far up to this point.

October

25, 2011: the SPX index is trading at 1250 I expect the rebound

to fail and new lows to be printed in November with a small recovery in

December.

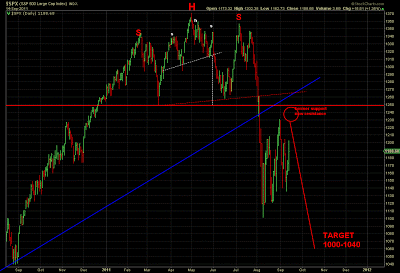

December

2, 2011: We saw no new lows in November but just a small drop with the

market quickly recovering by the end of November. The large picture

starts to take shape and the original forecast published in January now

is looking really non bad when confronted with the actual

market realization. The cyclical model I adopted to produce

the original forecast passed the test of time very well and it is

definitely worth working fore on it to refine it and improve it: it

correctly predicted the May 2011 top (and its level), the summer bearish

Head and Shoulder and the following drop and the base building process

of the last quarter of the year, it only failed in predicting a new low

in November.

December 29, 2011: time to review my forecast vs the actual market